The restrictions on physical interactions around the world have changed our lives and habits. And while the pandemic is destroying most industries, e-commerce is thriving. This article describes how dynamic pricing reinforcement training helps retailers improve their pricing strategies to improve profitability and increase customer engagement and loyalty.

It is vital for online retailers to keep pace with price movements. Overpricing your products may result in loss of customers to your competitors, while underpricing may result in lower revenue. In 2019, online stores brought online retailers $3.53 trillion in revenue. Moreover, by 2040, it is expected that about 95% of all purchases in the world will be made online.

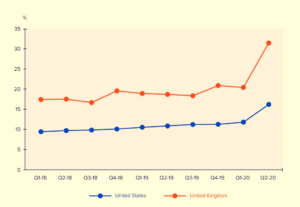

The pandemic has led to an increase in the share of e-commerce in the retail market

Dynamic pricing is a process of automated real-time adjustment of prices for goods or services in order to maximize income and other indicators of economic efficiency. To determine the optimal price, the dynamic price strategy takes into account the current state of the market, including the company’s previous price, changes in competitors’ prices, consumer tastes, time range and other exogenous factors.

Dynamic pricing strategies are applied in many business contexts and are used by airlines, railway companies, concert venues, theaters, car rental companies, housing suppliers and retail companies to quickly respond to market fluctuations. For example, Amazon tracks and changes the prices of its products every 10 minutes after updating and processing big data. Uber also uses a flexible pricing strategy in the event of high demand caused by bad weather or a specific event that pushes prices up.

Benefits of dynamic pricing for e-commerce

In today’s e-commerce world, many companies use flexible prices to remain competitive. Here are some key benefits of dynamic pricing in e-commerce:

Dynamic pricing for e-commerce: turning challenges into success

Although dynamic pricing has many advantages, the strategy itself cannot completely eliminate uncertainty about the response of consumers to various prices. In practice, solving this problem requires the effective use of sales data.

Sales data is time-series data that contains prices along with the relevant sales and other functions that can be useful to stimulate sales (for example, inventory, product seasonality, listing, and so on). This is the entry the company must provide to build a dynamic pricing mechanism.

There are two possible approaches to defining a pricing strategy using a forecasting model:

Approach to optimization. This is a simple one-step optimization. Using the forecasting model, you can set different prices and see how they will affect sales and revenues. This is an optimization problem with one variable in a continuous interval, which is determined by the minimum and maximum price.

The disadvantage of this approach is that it is rather greedy. In other words, it only considers income in the current timestamp, not total income over a longer period, which is the best choice for maximization.

Reinforcement learning (RL). An alternative approach that solves the problem of greedy decision-making. It takes into account the associativity between successive stages of pricing, thus being not greedy with respect to current time income, but greedy with respect to total income. For example, it may be beneficial to set a lower price in the current time stamp, reducing the possible income in order to enter better market conditions later.

Our company will help you with the development of e-commerce services.